Researchers have completed a new research note about alternative revenue mechanisms for the roadway and bridge infrastructure.

The increased adoption of alternative fuel vehicles, combined with the increased vehicle fuel efficiency, pose challenges to the revenue-generation ability of the motor fuel tax. In response to this issue, several states have explored alternative revenue mechanisms to bridge the funding gap.

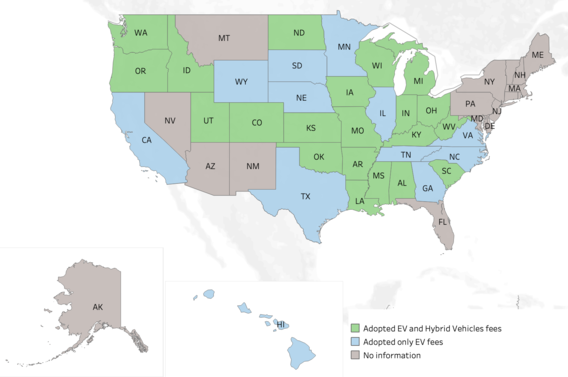

One mechanism has been the introduction of special registration fees for specific hybrid and EV models. These fees are levied in addition to standard motor vehicle registration fees, with the aim of ensuring that all vehicle owners, regardless of their choice of propulsion, contribute equitably to the maintenance and expansion of the roadway system. Across the U.S., 33 states have adopted a special registration fee for electric and hybrid vehicles (see map).

Another mechanism is the charge per mile, also known as a mileage-based user fee (MBUF), distance-based user fee (DBUF), and roadway user charge (RUC). Some states are exploring or considering RUCs, which link taxation to the actual use of the roadway by a driver. As of 2023, three states have enacted legislation and currently collect revenues from per-mile charges.